What is the API Banking Landscape in the Middle East

What is the API Banking Landscape in the Middle East ?

Whats the driving force

Globally, traditional banking is moving toward open data. The key driving force is the urge to protect the existing customer base, and expand & own the customer relationship. Whilst minimizing operational cost has become significantly important given the rise of bubbling fintech’s, this opportunity comes at a time when incumbent banks struggle with low performance.

Open banking industry is currently estimated to have $11 billion of global market cap, and at a CAGR of 23.98% it is predicted to reach a value of more than $52 billion by 2027.

Different types adopted by nation states

The open banking space is either regulator-driven or market-led initiative, and has multiple frameworks across various jurisdictions. For instance, in the EU, PSD2 framework applies to payments data, whereas in the UK Open Banking (OB) framework additionally requires publicly available information such as branches, ATMs, bank products, and fees. The EU has started to get consultations on PSD3, moving towards standardization and more mature use cases. NextGenPSD2 is a more advanced framework developed by The Berlin Group.

Worth noting is the largest number of Open Banking APIs published so far is by Singapore’s DBS Bank with 200+ APIs for loans, rewards, fund transfers and deposits., while Australia’s most sophisticated framework on the other hand provides “read-only” rights and plans to cover industries beyond banking (e.g.: energy sectors, telecom, etc.)

In the middle east, banks are more risk averse and prefer to own customer relationships.

Bahrain

is a regulator driven market, and has active regulations based on PSD2 & GDPR. Egypt is also regulated and has data protection laws ready, however an open banking framework is a work in progress.

Kuwait

which is also regulator led, is working on an open banking framework however they have yet to publish data protection policies which is an integral part of open banking, open finance, and open data.

Saudi

Although market led, Saudi‘s SAMA open banking framework is expected to go live in this year (2022) while Qatar National Bank (QNB) has launched an open banking platform in partnership with Ooredoo, which is a well-known Qatari telecommunications company owned by Qatar government-related entities and 10% by Abu Dhabi Investment Authority (ADIA) in the UAE.

Oman

The Central Bank of Oman (CBO) is drafting the framework albeit Nigeria has published Open Banking draft guidelines, at the same time Israel is catching up with their recent Financial Information Services Law.

United Arab Emirates

UAE is unregulated so far and is herded by the market with a facilitative regulatory approach. However UAE central bank has started to draft the open banking policies.

Abu Dhabi Islamic Bank (ADIB) decided to use UK Open Banking standards, but Arab Bank (Jordanian Bank) is following EU/PSD2 and has their API portal. They’ve published open banking APIs for services such as Strong Customer Authentication (SCA), Account information, Account balance, Transaction history, Payments & Transfers.

RAK bank, Abu Dhabi Commercial Bank (ADCB), and Emirates NBD bank have launched their developer portals, and we have yet to see newsworthy progress from First Abu Dhabi Bank (FAB).

However, Citi UAE has opened full fledged retail and corporate APIs such as, Accounts list, Account statement and Customer inquiry, and includes bundled services.

Open banking is still in early stages and therefore most common use cases are retail focused (aggregators, payments, bnpl, etc.) so far with their neo banking initiatives.

Digital bank players are YAP (neo bank by RAK), MashreqNeo (by Mashreq), Liv (by Emirates NBD) have direct integration and reuse their core bank’s infrastructure. Wio Bank and Al Maryah Bank have their own licenses.

Banks in the UAE are striving to quickly move into this space and avoid risk of losing market share.

Third parties are the catalyst to innovation

As much as frowned upon by banks, third parties in general and FinTech specially are an essential component of innovation and open ecosystem.

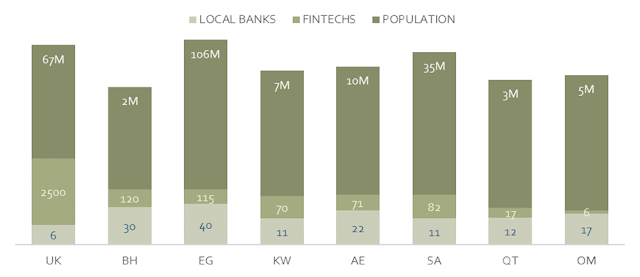

The chart above shows the proportion of the country's population (prospects) vs local banks, and the growing number of FinTech.

The UK has the lowest number of banks compared to its population and the highest number of FinTech’s, and hence leading innovation.

Keeping the UK as a baseline, which is leading the open banking space, Egypt has 40 banks, and putting that in perspective, even if you double the current UK population from 67m (with 6 banks) to 134m, then the UK will end up with only 12 banks.

We can see the disparity in the middle eastern region which is far off the baseline and a lot of work needs to be done to develop the policies and build infrastructure where the new players are welcome, onboard is faster, and innovation can thrive beyond the financial services industry.

Current open banking players in the region

Tarabut

Tarabut Gateway from Bahrain, claims to be MENA's first and largest regulated Open Banking platform and aspires to become Plaid of the middle east. They’ve onboarded more than 3 retail banks.

Lean

Saudi owned Lean (LeanTech) claims to be building an integration layer on top of the (retail) banking infrastructure in the Middle East. They recently got approval to access the central bank’s (SAMA) sandbox, and are very active in the region including UAE.

Dapi

Dapi is a Y Combinator backed fintech in the UAE that provides open banking access to retail customers. It lets partners leverage open banking APIs and connect their app to users' bank accounts, initiate payments, and access real-time banking data.

In one of the meetups during the Seamless exhibition they confirmed that, in some cases, web scraping is done to ensure consent and connectivity. This may pose a slight risk when a bank decides to upgrade their online banking web portal, it will impact Dapi partners.

Rapidly growing open banking providers such as SaltEdge (Canada/UK), Tink (Sweden, acquired by Visa), aiia (Denmark, acquired by Mastercard), and U.K. fintech start-up TrueLayer. Bankableapi is another upcoming UAE based API aggregator platform with a lot of promises.

The API based open banking makes information availability on-demand, instant and accurate which increases competition. When moving to API banking, banks need to decide on the business model between Owning the platform, Partnership model, or acting as a utility by providing Banking as a Service.