Are FinTechs an enormous competitive threat to banks?

Are FinTechs an enormous competitive threat to banks?

Demand derives innovation. Did you know, it is expected that 95% of the business-to-consumer (B2C) interactions will be Artificial Intelligence (AI) enabled by 2025? And as much as you hate it, AI-powered chat-bots will be a key component in supporting the next generation of customer experience.

There is a trend in the industry labeling innovation as a “disruptive technology”, simply because it challenges the status quo by providing better, more sophisticated offerings to the end user. See what Harvard Business Review say about it.

With the growing demand of hyper-connected consumer, banking is no longer something where you go; instead, it is becoming something that you do.

Closed Banking

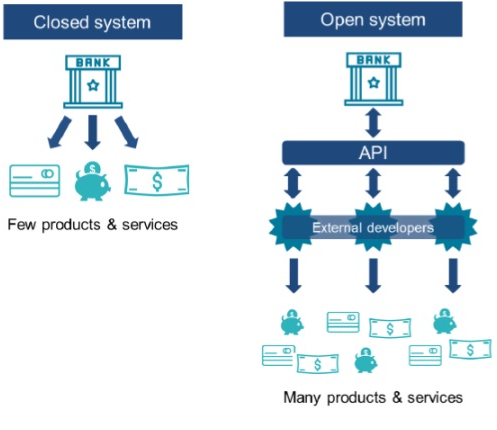

The traditional banking (Closed Banking) where only a bank can provide services to you using your banking information, in limited timeslots and offerings. No other bank could have access to your information even if you want them to. You cannot choose best rates across all the banks before an FX transfer. Certainly, you cannot go about opening accounts with all the banks either. The only option you are left with is to contact Western Union or similar agency for FX transfer.

Traditional banking is very rigid in terms of offerings and services.

Think of branches, limited service timings, currency based cut offs, delays, holidays, service timings, response times, minimum balance. Ofcourse there is a human element in the traditional one-to-one approach in banking however that is no longer viable, as it cannot scale. Sticking to old and existing concepts and offering isolated products to clients and prospects is not an option to survive in today’s increasingly competitive market.

A common challenge that several established banks face is the inflexible, ageing, core IT systems.

It is because the organic growth and acquisitions causes these systems to increase in complexity, which becomes difficult to support and maintain. I think you can see where I am going with this. It obviously becomes a huge obstacle to scale the products and services because these systems turn into black boxes and present serious risks to new offerings (forget about faster time to market, even if you come up with new offerings), when compared with agile and innovative challenger banks, neo banks, and FinTechs that are working on sophisticated offerings. As a result traditional software vendors charge huge dollars to make any amendments in an already spaghetti of complex infrastructure.

Today, amid COVID times, customers want a convenient and fast access to financial services on their fingertips, round the clock, retail as well as corporate customers alike.

Open Banking

While incumbent banks are grappling with changing customer demands and IT systems creaking under the strain of hugely increased workloads, the late 2010 saw the arrival of FinTech, which has now turned into an avalanche recently amid COVID times, and is now seen as banks mortal threat.

Many banks have open their FinTech arms or collaborated with software companies to white-label their products.

Here in this region such Mashreq Bank with Mashreq Neo, or Emirates NBD with Liv; or RAK bank with YAP (reverse of PAY) and others.

These FinTech are small, agile, lean/mean and aggressively focused on new businesses that used technology to provide a specific financial service better than the banks could. Many started by provided aggregated accounting services, now I am talking as far back as about ~5 years ago. Think of Mint.

They challenge the status quo

They challenge by offering a cheaper, transparent, user-friendly financial services through the creative use of apps (web based, or mobile based applications), platforms and websites.

Second Payment Services Directive (PSD2)

Infact Second Payment Services Directive (PSD2) especially takes the lead and focuses heavily on Open Banking. It encourages competition and transparency through an innovation-friendly approach by introducing Third-Party Providers (TPP aka FinTech) who can expand on the types of services as non-banking payment institutions.

TPPs are permitted to initiate payments, access bank–customer payment-account data, as well as provide account information services across multiple user accounts using open banking application programming interfaces (APIs).

For instance, Payment Initiation Services Provider (PISP), a FinTech who can initiate payments at the request of a user with respect to a payment account held at another payment service provider (PSP).

Also, Account Information Service Provider (AISP) that provides consolidated information on one or more payment accounts held by a user with one or more payment service providers.

And, Account Servicing Payment Service Provider (ASPSP) that can provide and maintain a payment account for a payer, publish read/write APIs to permit, with customer consent, payments initiated by TPPs and/or make their customers’ account transaction data available to others TPPs via their API end points.

What is future of banking & financial services?

I think the future of financial service offerings will go far beyond common conventional – be it retail or corporate. Especially in perspective of Open Banking, outperforming competition means adding value to clients in all the areas of banking and beyond.

Think Tinker.

New players have raised the bar so high that traditional players are compelled to increase and exceed in their core competencies and portfolios, by adding products and services from cross industries and building partnerships. While working to protect their customer base, as well as a focus on competing and expanding it.

Here, if you do not believe me listen for yourself, Jamie Dimon who is currently (2021) CEO of JP Morgan Chase Bank.

Banks are facing extensive competition from technology companies, both in the form of FinTechs and BigTechs (eg: Amazon, Apple, Facebook, Google etc) that is here to stay. Stripe is the next Google of financial services.

FinTech companies are making great strides in building both digital and physical banking products and services from loans to payment systems to investing; they have done a great job in developing easy-to-use, intuitive, fast and smart products.

Client expectations are being shaped beyond traditional industry boundaries with customers expecting to get in financial services the smooth, fast, easy customer experience they have been accustomed to over the past years in other industries.

Lead to success

A superior and customizable-personalized customer experience is the demand nowadays and xTechs (FinTech, RegTech, InsurTech, etc) that are the early ones to realize and grab this opportunity will add to their success.