How RegTech Innovations in FinTech Combat Financial Crimes & Revolutionize Security

So what is Regulatory Technology (RegTech)?

How is it different from FinTech, and how can it help? So many questions and answer is pretty simple.

Current issue(financial crimes)

Many governments at the federal level protect consumers from errors and fraud, and in some cases allow payments to be reversed up to 2 months after the consumer was notified of a debit to their account (see: https://www.nacha.org/news/faster-processing-and-settlement-ach-credit-transactions-begins-today-reaching-all-us-bank)

Financial crime, and the types of criminal activity that payments can facilitate, plus the measures that banks and other payment service providers (or third party providers TPP) can adopt in order to address, prevent and combat these frauds.

Criminals increasingly use scams to trick individuals into disclosing personal information that the criminal can then use to commit fraud.

Develop a RegTech

The new generation of FinTech companies are rising up the ranks to compete with banks that are more traditional. Some are using the cutting edge technology to innovate and break new ground in the area of financial crimes, cybercrimes and anti-money laundering.

A regulatory and risk management framework can be designed around payment business and provide great efficiencies by integrating financial and cybercrime prevention.

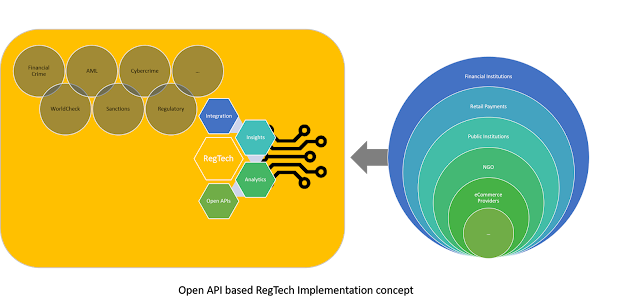

The concept

The overarching idea is to map the regulatory requirements to the current operating model and create a plan to address any gaps, whilst taking into account supervisory guidance and industry best practices.

Furthermore Artificial Intelligence & Machine Learning (AI/ML) is a good candidate technology for a FinTech to be able to meet the continuously evolving regulatory requirements. System can be designed using application programming interfaces (APIs) and micro services architecture.

Value add

It can add real value to the businesses by leveraging the insights from anti money laundering (AML) and fraud prevention systems to protect the organizations from cybercrime threats, an effort often lacking in more established organizations due to the fragmented (often legacy) development of the regulatory frameworks.

Since different financial sanctions lists are managed by different regulators around the world, payment service providers have to be vigilant in order to ensure that their sanctions filters are up to date. Therefore, using such a product/service FinTech companies and other technology-driven business models can free themselves from the traditional silo cross checks, due diligence, and etc.

These APIs may employ Artificial Intelligence and Machine Learning on the global big data to scan inbound and outbound payment messages for indications of illegal activity, such as terrorist financing.

A Regulatory Technology (RegTech) can aggregate data and provide a range of “RegTech related Business Services” as well as insights to informed decision making. Develop a central system from across the industries and automatically detect and flag possible frauds.

Just an idea.